Oddly enough, the one question that finally brought me to anarchy was: “where does money come from?”

It was perplexing to me that the answer to such a simple question could be so simple, yet so complex—and, moreover, absurd.

So? Where does money come from?

I found that the short answer is that new money is created by either 1) artificial bank credit expansion through the fractional-reserve lending process; or 2) the Central Bank prints it.[1] In both instances, new money is conjured, being created out of thin air, and injected into the economy through various means, thus eroding the purchasing power of those not privileged enough the enjoy the new money.

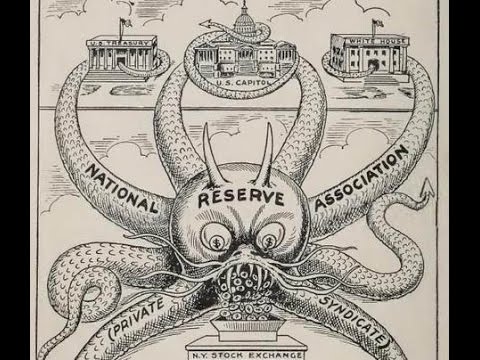

In other words, a state-enabled cartel of banks counterfeits it.

As Murray Rothbard explained in The Case Against the Fed, the counterfeiting process is enabled through the institution of Central Banking:

The Central Bank has always had two major roles: (1) to help finance the government’s deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm’s advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks’ inflationary expansion credit.[2]

Central Banking is incredibly damaging to the economy.

In short, the Central Bank’s manipulation of interest rates sends false signals to businessmen, causing malinvestments in high-order capital goods, “which could only be prosperously sustained through lower time preferences and greater savings and investments[.]”[3]

The “boom” signifies this period of malinvestment. Therefore, the resulting “bust” that rocks & shocks the nation, is the market clearing out the “wastes and errors of the boom.” Of course, the common people, seduced by the false promises of a “booming” economy do not receive a bailout, as do the private friends of government. The result is a massive transfer of wealth from the people and into the coffers of the state and their private-sector cronies.

Not only is the entire institution of Central Banking steeped in counterfeit and fraud, but it also encourages irresponsible behavior. Central banking gives the illusion of pooled resources where scrupulous toil and savings have created none. Therefore, artificially cheap credit encourages high time preference throughout society: get something for nothing today and shift the cost to future generations.

An additional driver of this high time preference behavior is inflation. Inflation is the increase in the money supply that occurs when the Central Bank prints more money. Inflation is usually signified by rising prices. From the point of view of consumers, why save money when it will be worth half as much in ten years?

Aside from siphoning wealth from the people and encouraging high time preference behavior, Central Banks facilitate the one of the vilest operations of the State apparatus.

In chapter four of “End the Fed,” Ron Paul identifies this most destructive consequence of central banking:

It is no coincidence that the century of total war coincided with the century of central banking. When governments had to fund their own wars without a paper money machine to rely upon, they economized on resources. They found diplomatic solutions to prevent war, and after they started a war, they ended it as soon as possible.[4]

To better explain how the above process occurs, consider a simpler example:[5]

The King of Ruritania decides that he does not care for the King of neighboring Moldovia. In preparation for his invasion of Moldovia, the Ruritanian King requisitions of his finance minister an accounting of the royal treasury.

Alas for the King, the royal coffers are bare. He may not be able to finance his new war! In response, the King issues a royal decree: all the official coinage of the land is to be recalled for reminting.

Once the currency is collected, the King melts the coinage down, removes ten percent of the silver content in each coin, and replaces it with nickel. The King then remints the new coins and fills the royal coffers the ten percent surplus of new coins. Suddenly, the King’s coffers are full, and the people are ten percent less wealthy. This process is called “debasing the currency.”

Since the invention of the printing press, the State has been able to replace hard money with paper deposit tickets, untether the hard reserves to those deposit tickets through legislation, and purchase assets with printed deposit tickets. The process becomes a bit more evolved, but money is created through the magic of the lending process.

Poof.

With the above answers in tow, it became clear to me that the Central Banking institution lies at the very core of the state apparatus. Without monopoly rights to print fiat currency, many of the State’s most destructive endeavors would be logistically impossible. This knew-found knowledge of this immoral practice hardened my natural skepticism of the state.

Even more perplexing than the answers I found regarding central banking, were the questions they evoked: how is the truth so well hidden from everyone? Why does no one even think to ask where money comes from? Why didn’t we learn about something so important in school? If a question this profound is so well hidden, is it deliberate?[6] If so, why? What else is being hidden from us?

[1] It then uses the newly printed money to buy assets from private banks and adds said assets to its balance sheet.

[2] “The Case Against the Fed,” page 58.

[3] Murray Rothbard, America’s Great Depression, page 11.

[4] End the Fed, page 63.

[5] This is Rothbard’s explanation of coin clipping from the Mystery of Banking

[6] It is deliberate. See James Corbett, a Century of Enslavement; How Big Oil Conquered the World